by StubbornCreative | May 20, 2024 | Investing

What is an over 60’s seniors Reverse Mortgage?

by StubbornCreative | May 8, 2024 | Home Loans and Mortgages, Investing, Refinancing

What is an over 60’s seniors Reverse Mortgage?

by Ray Dib | Jun 9, 2020 | Investing

Property Investment Guide Your guide to financing an investment property The Australian property market has performed consistently well over the last decade. This has inspired more people than ever before to invest in property. The prospect of attractive yields from...

by Ray Dib | Oct 20, 2017 | Home Loans and Mortgages, Investing, Refinancing

Cross Collateralisation or Stand Alone? Cross Collateralisation is a term used when the collateral for one loan is also used as collateral for another loan. If a person has borrowed from the same bank a home loan secured by the house, a car loan secured by the car,...

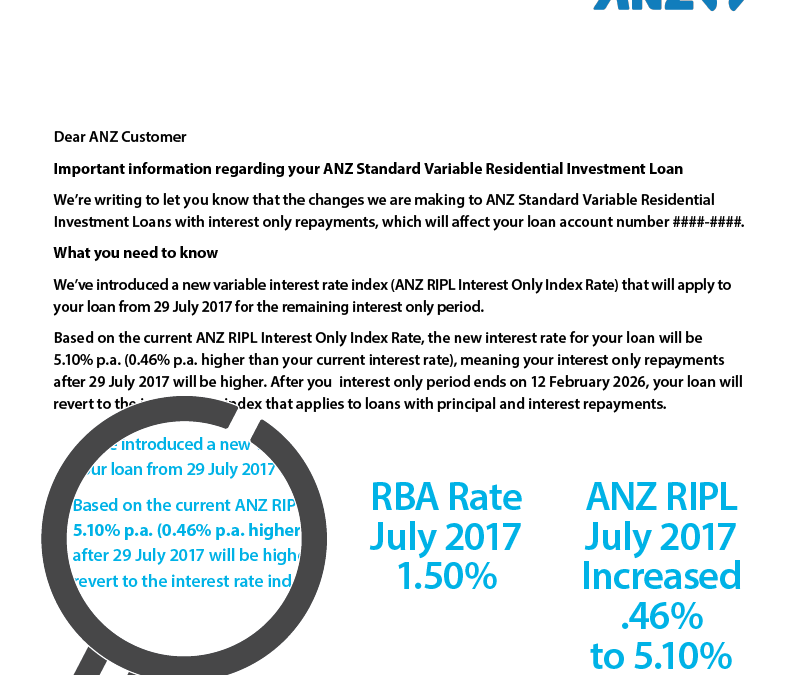

by Ray Dib | Jun 6, 2017 | Home Loans and Mortgages, Investing, Refinancing

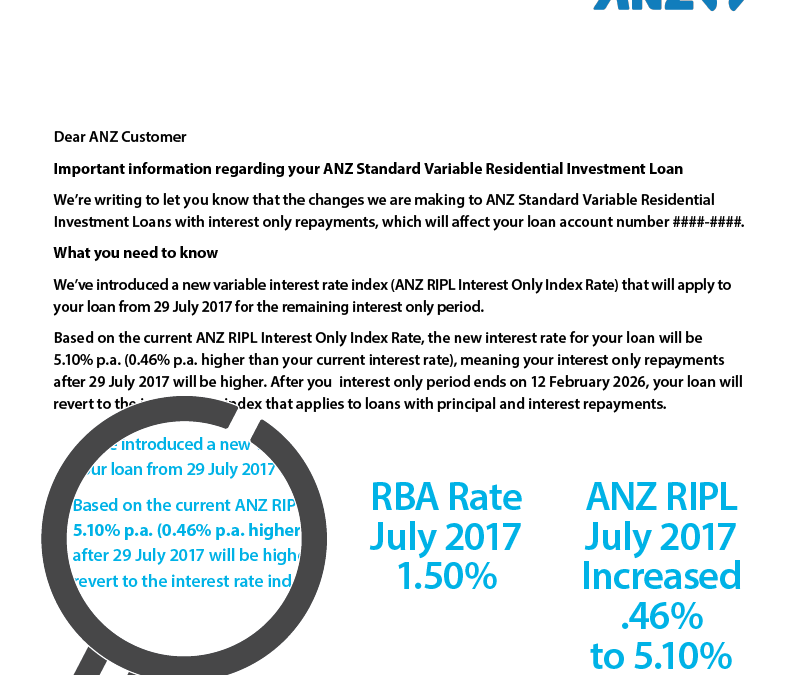

ANZ - that's just rude! Bugger The Banks Rate increase of .46%! That’s just rude. I received a letter from my bank a few days ago, advising that my interest rate is going up a massive 0.46% without any story! Normally they provide a bullshit story with the...

by Ray Dib | Apr 20, 2016 | Home Loans and Mortgages, Investing, Refinancing

Extending or rolling over your interest only loan?What you need to know. Call to find out more: 07 5532 0030 Extending or rolling over your interest only loan It is important to understand that all banks have varying policy when it comes to wanting to extend or roll...